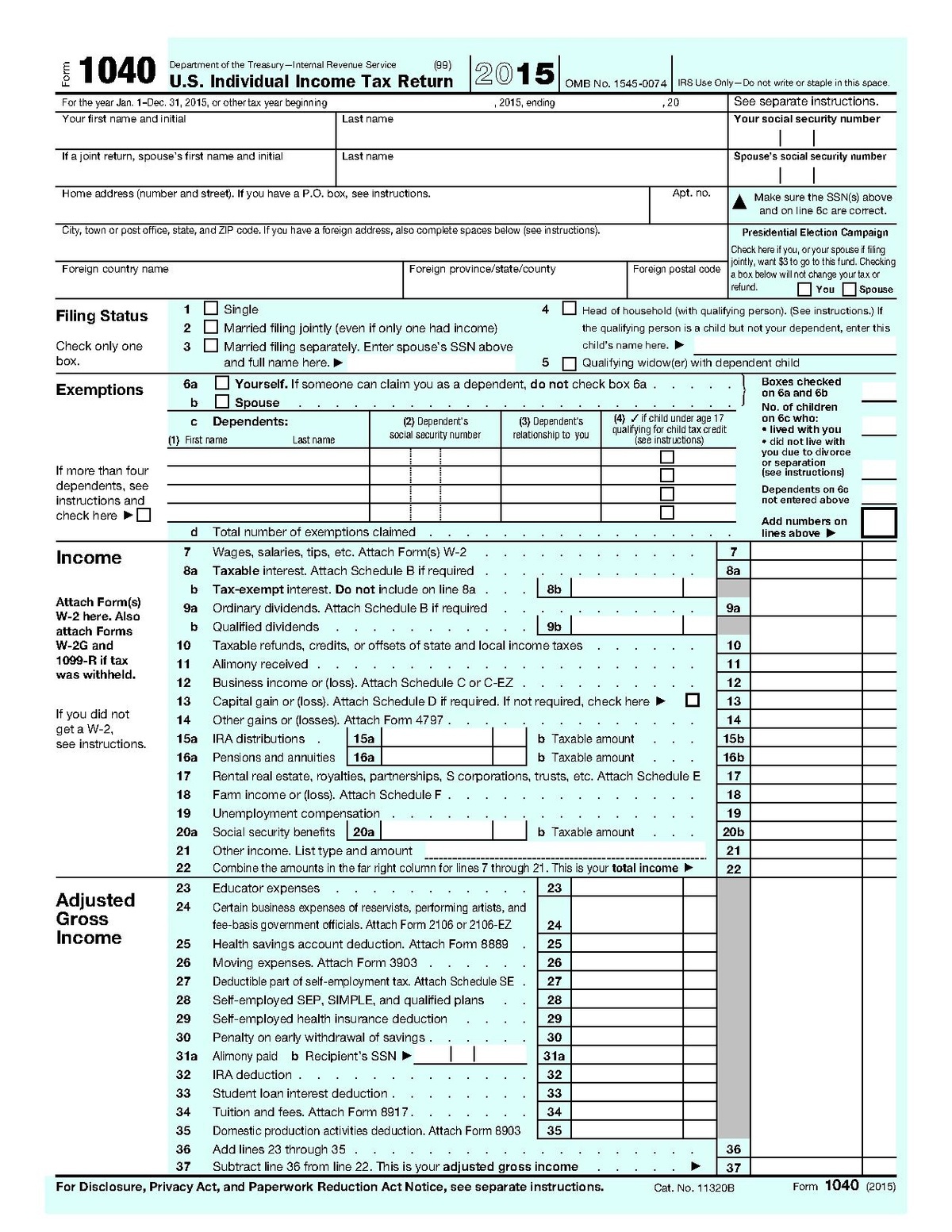

Maryland fill-out forms use the features provided with Acrobat 3.0 products. To do so, you must have the full Adobe Acrobat 4.1 (or newer) product suite, which can be purchased from Adobe. IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process. You can also print out the form and write the information by hand. You must have the Adobe Acrobat Reader 4.1 (or newer), which is available for free online. A change worksheet that records revisions to the spreadsheetĢ.Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form.SSA-1099 input form to record Social Security benefits.1099-R retirement input forms for up to nine payers each for a taxpayer and their spouse.

1099-DIV dividends and distributions for up to ten payers.1099-INT interest income input forms for up to ten payers.W-2 input forms that maintain up to four employers and their spouse.A disclaimer worksheet that also includes a high-level summary.Line 44: Qualified Dividends and Capital Gain Tax Worksheetįive additional worksheets complete the tool:.Line 42: Deduction for Exemptions Worksheet.

0 kommentar(er)

0 kommentar(er)